A Malta financing company is very widely used by international groups of companies that wish to centralise the internal treasury management of the group.

Malta is very widely used as a financing company jurisdiction for various reasons, namely:

- cost effectiveness of running a cash management function out of Malta

- efficient taxation of finance income (interest spread) in the hands of the Malta financing company

- no thin capitalisation rules ensuring that with proper structuring, a Maltese financing company can be a tax efficient back-to-back financing vehicle, with no withholding taxes on outbound interest payments

- tax efficient repatriation of funds to the owners through tax-free dividends

- no specific transfer pricing rules exist and therefore there is a high degree of flexibility on interest rates chargeable on intra-group financing

Malta tax considerations:

Foreign withholding taxes considerations (in order to arrive at reduced or no withholding tax):

Cross border interest payments are frequently subject to WHT in the country of the borrower, which may be reduced by the terms of a tax treaty between two contracting states. Malta operates one of the most extensive treaty networks in the world and this ensures access to reduced withholding treaty rates. Many treaties provide for a nil withholding tax rate, while others provide for a reduced rate between 5 and 15%.

Moreover, due to Malta’s EU membership, the EU Interest and Royalties Directive applies and an exemption is possible in respect of interest paid between related companies.

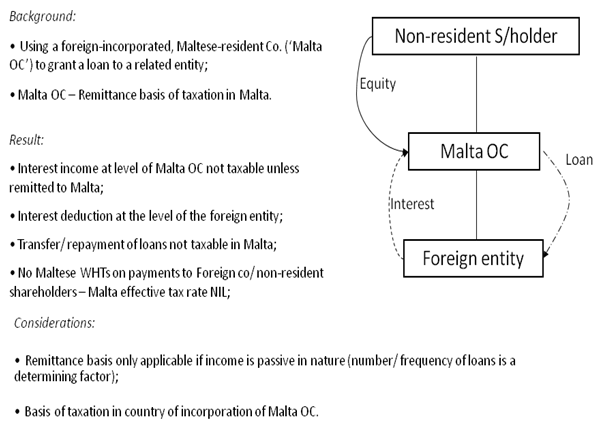

If the company does not trade in loans and it can be proved that a loan/s held are not trading but passive loans, then it is possible not to be taxed in Malta on the interest income by the setting up of an Oversea Company as follows: