The acquisition of a pleasure yacht requires a substantial capital outlay and accounting for VAT on such purchase price increases the cost considerably to the owner since normally such VAT is a non-recoverable cost.

Malta provides for an alternative arrangement whereby the yacht is purchased by a Maltese company, which in turn, leases that yacht to the ultimate owner. This results in the owner being in possession of an EU VAT paid certificate which would allow the owner to sail the yacht in any EU port. The VAT paid certificate of documents confirming the eligibility to this regime is important to be kept on board.

VAT advantages of the yacht leasing arrangement

When a pleasure yacht is purchased from any EU supplier or else from a non-EU supplier and imported into the EU, VAT always applies and cannot be recovered. On the other hand, a Maltese Company may be formed to buy a pleasure yacht which will be subsequently leased to the owner.

VAT is due at 18% on the purchase or importation of that yacht, however, the Maltese company may claim back such VAT, since such acquisition or importation is made in relation to subsequent taxable supplies.

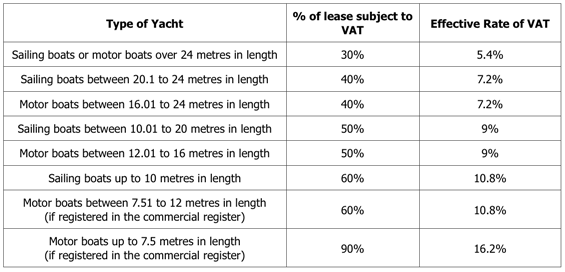

The company will in fact enter into a finance lease agreement with the owner. VAT is payable on the lease payments, however only on that portion of the lease during which the yacht is used in EU waters. Malta has set out guidelines which establish the presumed portion of time spent in EU waters, based on the presumption that the larger the yacht, the more it can travel outside EU waters and hence less time is spent in EU waters. The effective rate of VAT shall vary on the size of the craft but can be as low as 5.4% for a boat 24 metres long.

The finance lease can be over a 36 month period after which the owner will have the option to buy the yacht. At the start of the lease, 50% of the value of the lease has to be paid.

In terms of common VAT rules adopted throughout the EU, yachts have to visit the selected jurisdiction before accounting for VAT, and it is not possible to remotely reclaim VAT. Because of Malta’s geographical position in the centre of the Mediterranean Sea, this rule places Malta at an advantage over other jurisdictions with similar arrangements, such as the Isle of Man.

Income tax advantages of the yacht leasing arrangement

The Maltese company is expected to make a profit from the leasing agreement over and above the value of the boat. For tax purposes, the only profit that is subject to tax is the annual finance charge. Moreover, if the company distributes such profits as dividends, shareholders may claim a 6/7ths refund of the tax paid by the company.

Where the lessee exercises an option to purchase the yacht on the termination of the lease, the purchase price received by the lessor shall be considered to be of a capital nature and no tax thereon shall be payable by the lessor.